I am a property investor.

I love being a property investor.

I’ve been fascinated by property investment ever since I worked in property management as a teenager and saw the industry from all sides.

I have read so many books, done courses, worked in the industry for 20 years and also got accredited as a Qualified Property Investment Advisor (non practicing).

I bought my first investment property when I was 21 (well it became an investment after I lived in it first up). I still own it to this day.

I’ve had good property experiences, bad property experiences and a mixture of everything in between.

BUT I am the very first person to say that property investment is NOT for everyone.

The ups and downs of owning an investment property can be brutal. The highlights reel we all seem to see on social media can be glittery in nearly every aspect of life, but as we know the truth often lies in a much more middling zone.

I wanted to show some real facts, not to dissuade anyone from property investment but just to make sure that before they make this real and illiquid decision (meaning you can’t get out of it easily!) that they’re aware of a few hard truths. These are of course my opinion only, but it’s from the experience of owning investment properties for over 20 years and being a former real estate agent for 20 years who for the last 8 years of my journey ran a specialist property management only company).

Here are my thoughts

If you’re not prepared to put in your own cash, sometimes significant amounts, you should not have an investment property. Properties rarely pay for themselves – they will require your input.

I’ve spoken to clients in the past few weeks who have had:

– Months of vacant time and costs due to situations outside their own control (death of a tenant for example).

– Significant costs for repair and upgrade works required (roofs, heating, bathrooms for example) that are not covered by insurance.

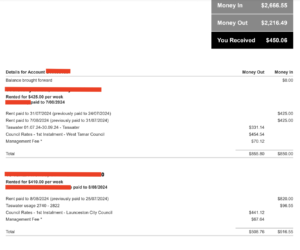

– Even in a normal month, you can have significant outgoings that mean you’ll be out of pocket. I’ve copied below the statements for 3 of my investment properties for a recent fortnight. The bottom line is here, there was $2666.55 worth of income in and only $450.06 of it went to me. From that I have to pay my mortgages, the interest, the insurance and a number of other costs and this was a fortnight that had zero maintenance / unexpected costs. This is not rare.

Property does NOT always go up in value. It’s a lovely myth that we like to use in Australia but it’s not true. I’ve worked with many clients who have suffered losses on property.

Legislation in many states is significantly weighted towards tenant protection, not owner / property protection.

Again I want to restate that I love being a property investor. It’s something I understand the risks associated with and I also love the process with it. However, it’s not a decision to be entered into lightly. Before you make the journey do your own research, think about worst case scenarios and have a read of all our other resources here: https://www.uploans.com.au/investment/

– By Kirsty Dunphey