This blog comes on the heels of me renting out my family home which I’d lived in for 17 years and not remembering, until it had been rented out for nearly a year and a half, that I hadn’t had a depreciation schedule done!

As a former property manager, real estate agent and a long-time property investor I should know better – but it slipped my mind so it might easily slip yours too.

First and foremost, if you want to know if you should consider getting a deprecation schedule done on your rental property chat with your accountant. It is not limited to domestic housing but can be applied to all income earning property including your office, factory or other industrial/ commercial property.

If the domestic property has been built or renovated after September 1987 you may be eligible to claim Capital works depreciation. Any asset that is NEW at the time of first rental can also be claimed. Assets are items such as cook tops, ovens, dishwashers, Hot Water Services, blinds etc.

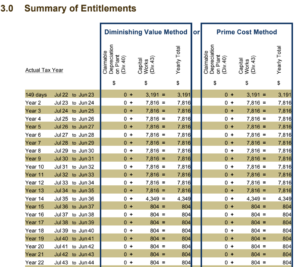

In my case, my building was completed in 1995 and as you can see from an excerpt from the depreciation report below, I was able to claim $3191 for the first partial year it was rented, and then $7816 for the next 12 years in addition to smaller amounts in years to come. Well worth spending the cost of a depreciation report.

As always, chat with your accountant and if you’d like a recommendation for an organisation that can assist with your depreciation report please reach out to your broker.