On maternity leave and wondering how a bank will treat your income? It’s a great question!

Here are the key points for if a bank will count your maternity leave income.

- You must be returning to the same place of work you left (if you’re starting a new job for a new employer that sadly doesn’t count).

- You must be returning to guaranteed part time or full time hours (not casual, unfortunately).

- We have to be able to show how you’ll cover any shortfall in the way the bank see you have to afford all debts until you return to work (this can be cash savings, redraw or perhaps a gift from family members).

- We must have a letter from your employer which confirms the hours, pay and date you will return.

It’s important to note: Banks do not work well with maybes, so this letter has to map out a definite plan (eg. Sally will return on the 14th of February 2023 to her position as an underwriter at 48 hours per fortnight on a rate of $60 per hour). - If you are receiving maternity leave pay or payment for annual / long service leave while on maternity leave it’s best if your letter also spells this out.

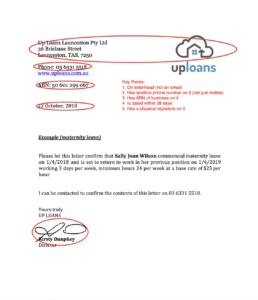

Here is an example of how that letter should look:

Superannuation sharing

While one partner is off work caring for your bub or bubs superannuation will be impacted. In Australia, couples are able to share superannuation during this time with the partner who is working contributing part of their superannuation towards the non-working partner. This is a beautiful way to ensure that the work that the partner at home is doing is valued, and that both partners long-term financial security are looked after during this time.

Frequently Asked Question:

– What if I don’t return to the same hours as is listed on the letter?

I’m a mum, I get it, having to put together a return to work plan while your Bub is little or sometimes before they’re even born is based on your best estimate of your return to work plan. The bank need certainty to know that you have a job to return to and you are able to return to a certain number of hours if we need that income to show you can afford the home loan.

As always, if you have any other questions, send an email through to our team- we’re always happy to help!

- Kirsty